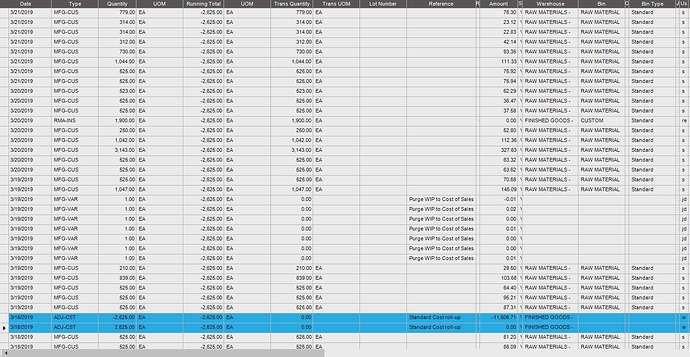

@amaragni There are parts that have cost adjusted out from the Cost Roll-up but nothing was adjusted back in. So, the dollar amount associated with that part is showing a negative in the Cost Roll up. How do I add those costs back in?

Which column is the running balance?

you have negative inventory, cost * -inventory = -$inventory. I don’t understand what the problem is…

Because my accounting manager says it should not be negative and it is throwing that whole dept into a negative adjustment. This is one of the three parts in this dept that have this going on. Anyway, I was asked to see if it was possible to add back in the 11,506.71 that was taken out.

I think he wants to know why the 2nd highlighted line shows an amount of $0.00.

Yes! Sorry for not being clearer.

what was the cost on the part before the roll? I would guess it was 0 right? Can you look at the material unit costs before the cost roll and see what those are?

editMaybe not. If that column in transaction amount, that it wasn’t.

Maybe half of the system doesn’t like negative inventory?

Yes, there were and should still be zero. Basically, this part got caught in the Cost Roll up and it shouldn’t of been rolled up.

do a manual cost adjustment back to 0 then. ( I would test first though)

Two issues you need to address:

- Why the QOH went negative, and how to prevent it from happening in the future.

- How to “fix” the existing “errors”.

As for how it happened, it looks like this part is regularly shipped from WIP to the customer. At least that’s what all the MFG-CUS trans mean. My guess is that the parts were being manufactured, but shipping was pulling them from stock. This would have happened well before the screenshot shows. Scroll back to see when the running balance went negative. I bet you’ll find STK-CUS trans.

I already checked and this has been going on for years, way back even before I started. I grouped the whole thing by the running total, and since the beginning it was -2,625.00.

Scratch that! I as wrong! 2/27/2019 was when it dipped int o the negative. Apparently the group by doesn’t work very well.

Wht type of Transaction drove it negative? ADJ-QTY ??? STK-xxx ???

It was an STK-CUS

So a shipment exceeding the QOH happened.

I’d guess that the parts were manufactured, but never received into stock. If that’s the case, then there is $$$ in WIP that that are in limbo.

For as out of whack as it can appear, the system is never really “wrong”. It’s just in a different state than you expect (or want). As far as accounting is concerned, dollars go from inventory to WIP to Finished Goods to COS. Or if shipped from WIP, they go Inv -> WIP -> COS.

If you need to ship 100 but only 25 exist in FG, you make a job to mfg 75 more, with their destination being inventory.

You then issue parts to make 75, say at $100 each. This credits Inv and debits WIP.

You then forget to receive those 75 to FG, but instead ship 100 from FG. FG is credited 100 x $100, and COS is debited the same amount.

QOH goes from 25 to -75. While this makes FG have a negative value, it is actually offset by the value left “orphaned” in WIP. When you close the Job this value becomes a variance, and is captured in the variance account. A JE is needed to reconcile that amount in the Variance Acct, with the FG account

something is still goofy. The cost on the parts before the adjustment look like.

81.20/525 = $0.155

after the adjustment

87.31/525 = $0.166

the difference being a $.011 increase in cost.

multiply that by -2625 *.011 = -$28.875

The swing in inventory value should have been under $30. Where did $11K come from?

edit scratch all of that. The amounts are all over the place. Are we looking at the right column?

What column you want to see?

Unit Cost, and Inventory Trans.