Not familiar with tax/finance stuff. Company wants the sales tax for each line to post to the same GL as the price of the product. Right now all sales tax is posting to the same miscellaneous GL.

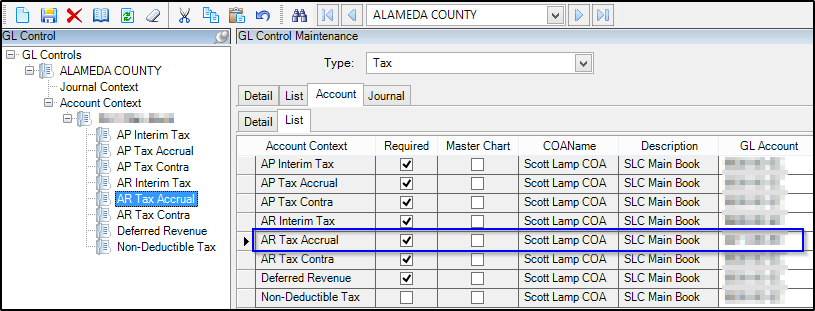

You can define the GL’s for sales tax in;

Financial Management / Account Receivable / Setup

Tax Type

So that would make all sales tax go to that one account correct? Would the only way to have the sales tax follow the Gl account of the product group be custom posting rules then?

@E102016 You highlighted AR in the screenshot, but it’s AP, right, since @Evan_Purdy is asking about a PO…

Correct. All taxes assigned to that tax type would go to the AR Tax Accrual GL. That would probably be the way forward. It looks like you can have multiple GL controls assigned to a Tax type but not sure how that would work as we have always used in a one to one environment.

You are correct. Read the body of the question as Sales Tax and assumed AR.

If it is on the PO side I believe you will need the Landed cost module to accomplish. If you direct the Sales Tax to an inventory account for your parts without it being linked to the part eventually your GL will be all screwed up. The cost will go in the the inventory account but will never come out.

What is the end goal? To see the total cost of the product?

We probably aren’t doing something properly. I know our current process is to smush the tax into the unit price and leave the tax box unchecked. This is a pain in the butt if your PO includes a mix of taxed and untaxed items. So we were hoping we could change the tax checkbox to work the same as if the unit price included the tax, but its not posting the same.

I guess I don’t understand why the tax is treated differently than the cost of the product to begin with? Maybe if someone could explain that it would be come clear what we want doesn’t make sense…