When looking at the Customer Entry customization, I noticed shapes for Tax ID validation. We had originally written custom code to go out to the VIES VAT Validation website through an API call to determine whether or not a given VAT number was valid for a specific country/member state. Turns out Epicor integrated this into Kinetic.

However, their documentation on setting it up is non-existent and support wasn’t actually sure what the functionality of the field was. Super helpful! I figured if anyone else is looking to implement this functionality, here’s the steps I took that worked for our company located in the Netherlands.

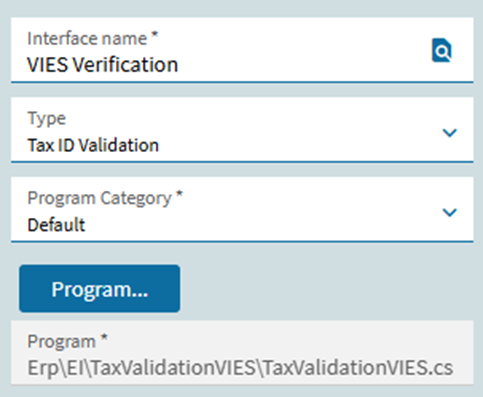

The program files (C#) for verifying Tax ID are located at \[server]\c$\inetpub\wwwroot[instance]\Server\Erp\EI\TaxValidationVIES.

-

Electronic Interface - Create a new Electronic Interface and tie it to the program for verification.

-

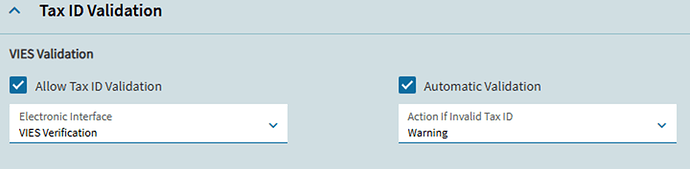

Company Configuration - Click Modules > Taxes > Tax ID Validation. Check Allow Tax ID Validation and use the VIES Verification interface we created in step 1.

-

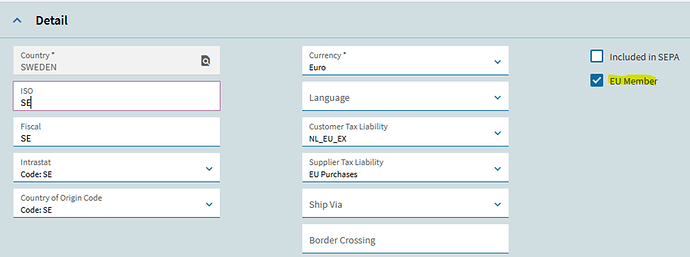

Country Entry – Any country in the EU needs to be designated as such in order for the VIES program to run.

-

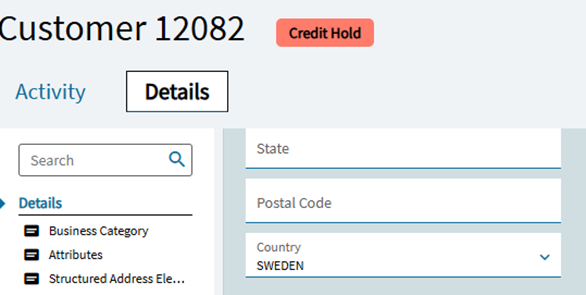

Customer Entry - Test the validation. Ensure the country designated is a member of the EU.

-

While still in Customer Entry, navigate to Billing. Here we will test:

-

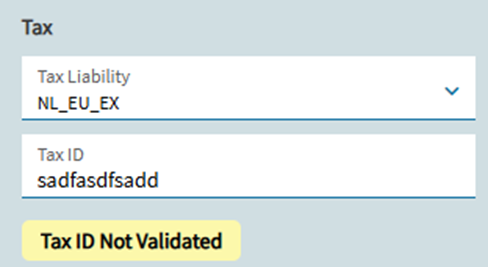

Test: Enter a gibberish Tax ID. Result: Tax ID Not Validated

-

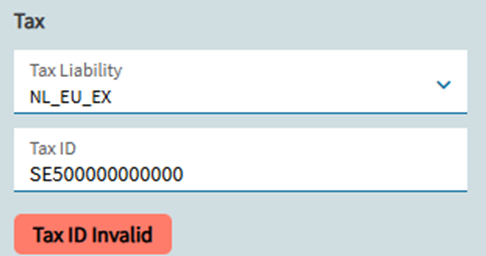

Test: Enter a Tax ID with the correct format that is not a valid ID. Result: Tax ID Invalid

-

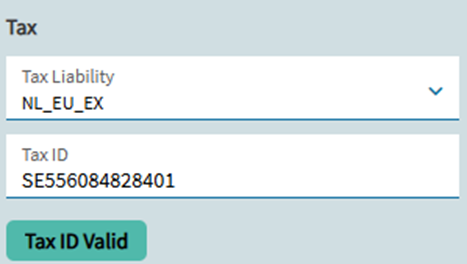

Test: Enter a valid Tax ID. Result: Tax ID Valid

Hope this is able to help someone else. I’m still working on the HRMC part of things.