We’re in the process of implementing Avalara for tax purposes. I am under the impression I need to clear all of our existing tax settings. One that is eluding me is the Tax Category on Order Lines. We don’t have any parts or product groups using a tax category but yet all of our order lines appear to be marked Exempt, which is the only tax category we have defined at all. What could be making that happen? I don’t see a BPM in play… What else could it be?

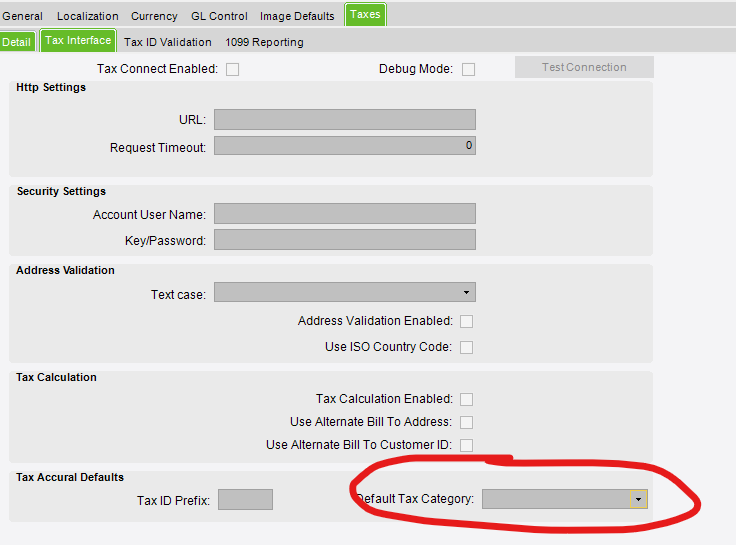

There’s a Default Tax Category in Company Config. All Modules → Taxes → Tax Interface

I am about to clear all those out at go live in a couple weeks when we switch to kinetic and to avalara. Going to need to clear it on all the open orders

Customer maybe?

product group

Yeah there’s a few more I think… Product Group

All our product groups are set to be blank, also.

Dan, are they copying orders?

That’s a good thought. I’ll double check… but my guess would be no because we have such a variety of products and there is a high emphasis on creating orders from quotes. That said, I’ll see if anything is forcing it on quotes.

Copying is the only thing I can think of.

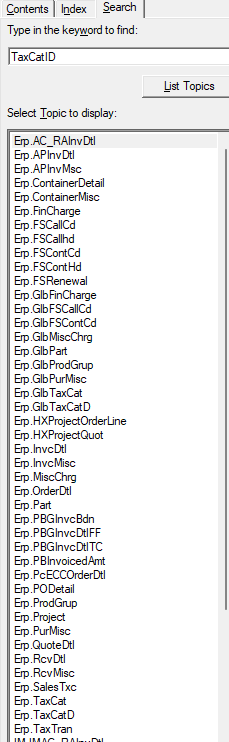

Here’s a list of tables that come up in @hkeric.wci 's 2022 CHM when I search for TaxCatID. Not sure if these will lead us anywhere.

Look at some of those base tables like Part, Project, ProdGrup

HEre’s what came from OrderDtl chm that haso put together:

OrderDtl

TaxCatID Indicates the Tax Category for this record. Defaults from the the or from the Part Master.

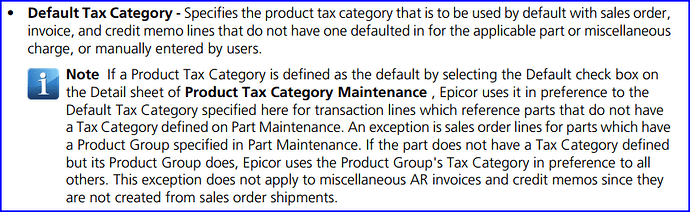

Might seem like a silly question, but… is the “Default” check box selected for the sole “Exempt” tax category that you have defined?

Nice find Scott!

Yep. That was it. I unchecked the box. Now we’re good to go. @ScottLepley for the win! Thanks everyone who helped!

scott what reference guide did you drum that up from?

Glad that I could help, @dr_dan!

Personally, never have I ever inadvertently checked or not checked a check box in the application… nope, never, not once, if it happened, then someone else did or didn’t do it!!! ![]() Don’t you just love how having a simple check box checked or not checked can sometimes send you down a rabbit hole and consume hours of your life??? Sometimes, I think it would be more straightforward if the application just had a “F*** ME!” check box in Company Configuration!

Don’t you just love how having a simple check box checked or not checked can sometimes send you down a rabbit hole and consume hours of your life??? Sometimes, I think it would be more straightforward if the application just had a “F*** ME!” check box in Company Configuration!

Good luck with your switch to Avalara! Just out of curiosity, in how many states are you, or will you be, registered? Here, we were registered in 2 states prior to the advent of economic nexus… now we’re registered in 40! Cannot imagine trying to handle that BURDEN without using Avalara!

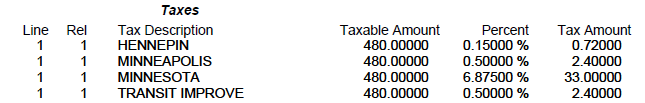

I think we were in like 7 or 8 states prior to this. From the orders I’ve put in to test I’ve already seen some silly tax structures that I am glad I didn’t have to try to keep track of. Here’s an example of an order written in Minnesota…

If it pleases the court…

Epicor Tax Connect Configuration Guide 10.2.200, page 8, step 9, bullet 2! ![]()

I thought so man, it looked ooooollllllld.