In converting FIFO Cost to standard Cost, do we need to convert our raw materials too from FIFO to standard? What shall we do with the variances computed after production when using a standard costing method?

Epicor ERP does not require that all parts belong to the same costing method. That said, it can be confusing if some parts are Standard and others are FIFO.

BUT… when you have a Standard costed assembly made from FIFO costed materials, you will need to set a standard using a cost roll… that cost roll will need to use some fixed number (last cost?, Average Cost) as the basis to set the standard for the parent.

When you complete a job that makes a standard costed part, there will most likely be variance. Even in a perfect std costed environment using backflush, you get variance. variance is not “bad” or something to be “avoided at all cost” (no pun intended). Variance is a value that tells you multiple things, or could be caused for multiple reasons:

- usage variance - you used more or less than the BOM called for

- Cost change - the cost of the component changed since the cost roll was done

- scrap - partially completed items were never completed.

The difference between the budgeted value of the job (standard cost) and the actual cost of the job goes to “variance”… this variance is part of your cost of production, but is classified differently. Instead of posting the variance directly to the FIFO Value, the standard cost goes to stock, and the variance is immediately written off as variance.

Hi Tim, Thanks for your valuable reply. Having said that the variance is immediately written off as variance, how do we do that?

when you receive the parts from the job to stock, the Standard cost is relieved from the job.

When you close the job, and do a Wip/Cost Capture process, any difference between Standard and the Actual charges to the job will be charged off to Variance.

Hi Tim, yes you are right that any difference between the standard and the actual charges will be charged to variance. But what do we do now with this variance, will it just stay the in the financial statement as a variance, or we have to do a journal entry to eliminate it. Thanks much.

it will be automatically charged to the variance account that is listed in the Product group when you do the Capture process. if you dont like the GL account that it is going to, then you could change the product group’s settings. you should not have to do any manual reclassification.

Okay, thanks. Currently we are using a manufacturing variance account.

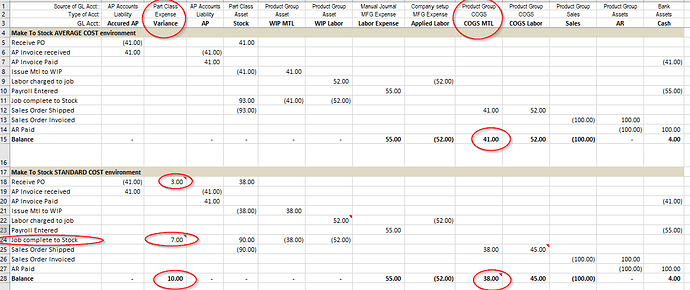

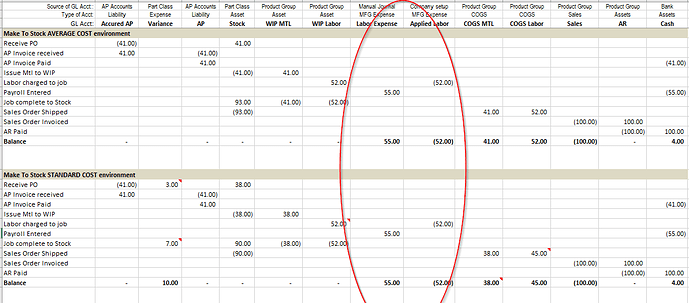

Check out this tool that I use to teach the difference between Average and Standard cost:

It should also be noted that there are different kinds of variances… the Std Cost variance is directly captured as discussed previously… But an example of a “variance” that does not have a variance account would be a Payroll Variance (also illustrated by this spreadsheet)… When Payroll is paid, it is a manufacturing expense which happens on a different day then when the “Applied Labor” is charged. Applied labor happens when hours are charged to the job (times the Resource labor rate). payroll will almost always be different than applied labor due to Breaks, down time, etc… but note that three is a difference between the Payroll and Applied Labor… this difference is a “variance” of sorts… it is “unapplied” labor… it is part of the manufacturing expense but is not directly part of COGS. This spreadsheet example is “too simple” in that it does not show “Applied Burden” (aka Overhead) which should theoretically apply all other manufacturing expenses to WIP as the job is done… thats when accountants get to look at the over/under applied labor/burden to determine if they need to increase/decrease the labor/burden rates that will be applied next period.

Thanks for your help Tim, I’ll study this spreadsheets and will ask again from you if I get confused along the way.