Hello @faepigrl ,

My test consisted of this using the Epicor Education Database

-

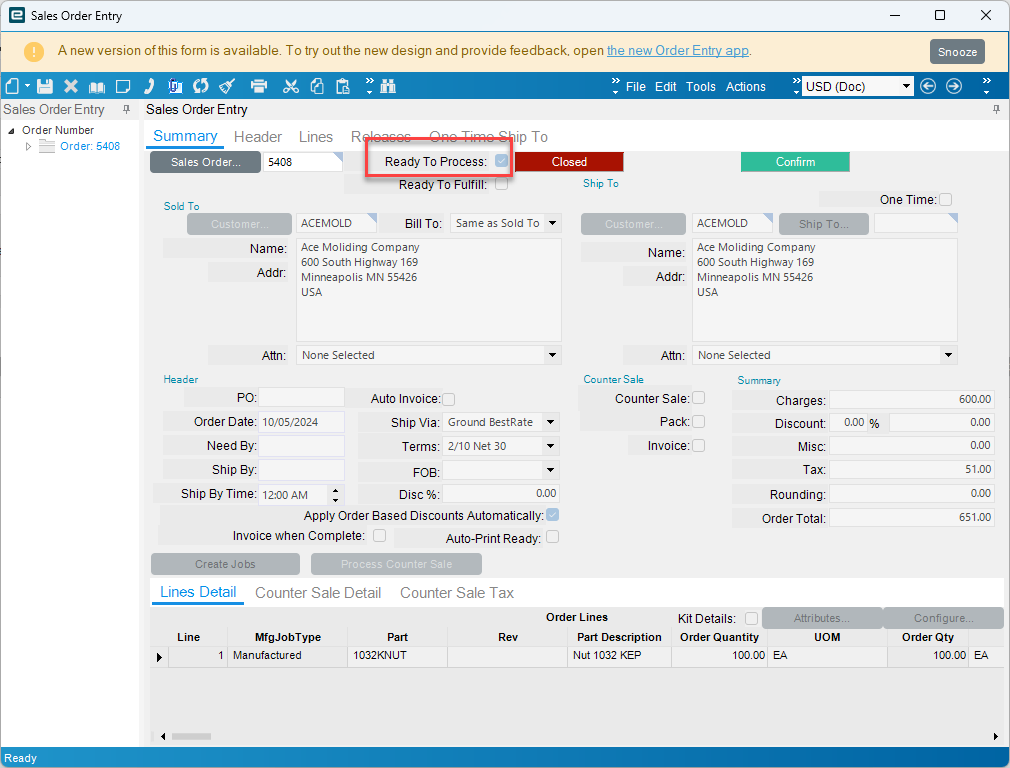

Create a sales order for ACEMOLD (Ready to Process checked, tax field has data)

-

Ship the order with customer shipment entry

-

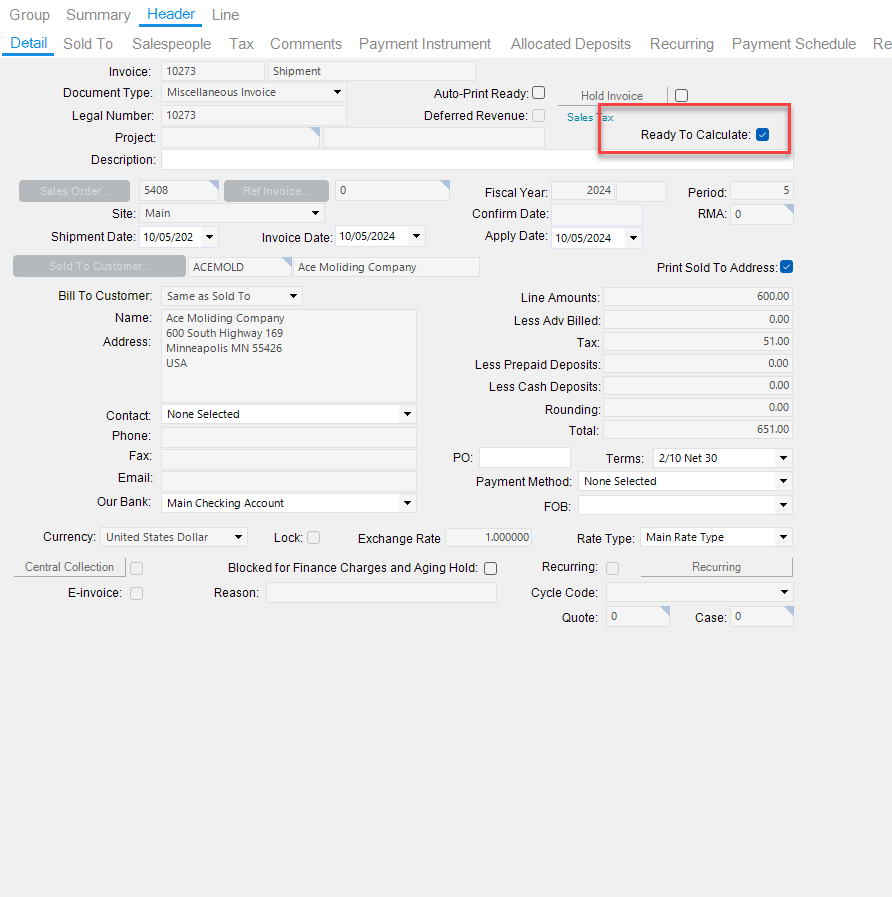

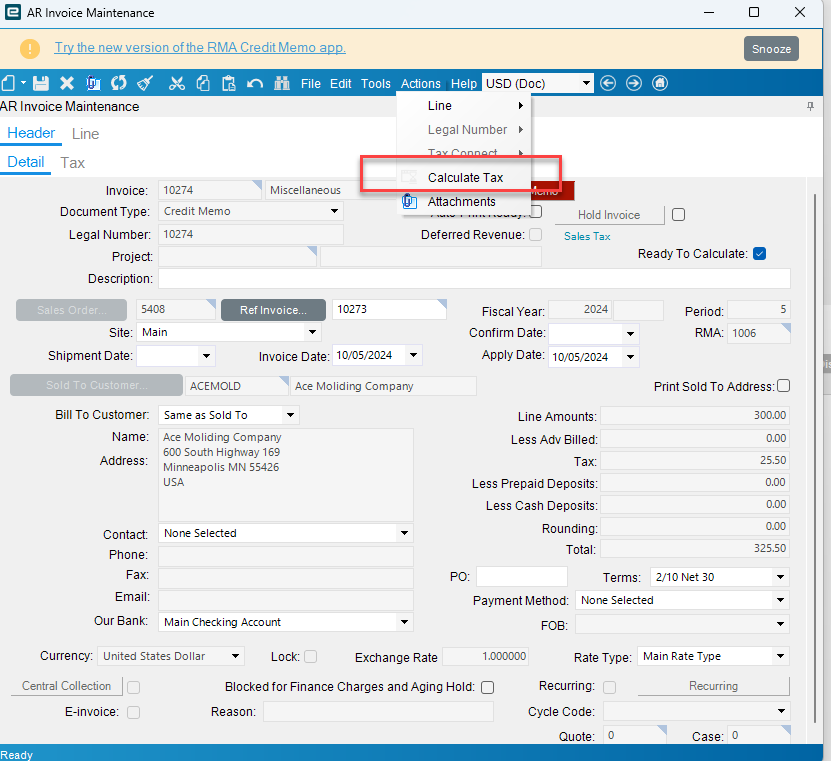

Invoice the Shipment with AR Invoice Entry, Note Ready to calculate already checked and the tax field has data

-

Raise an RMA (New RMA, Select customer, Select legal number, Add new line, receive a qty)

-

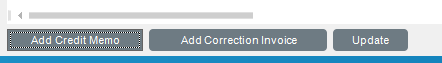

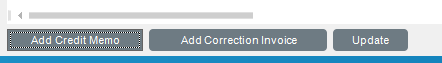

In the Credit tab of the main RMA Summary tab click Add Credit Memo

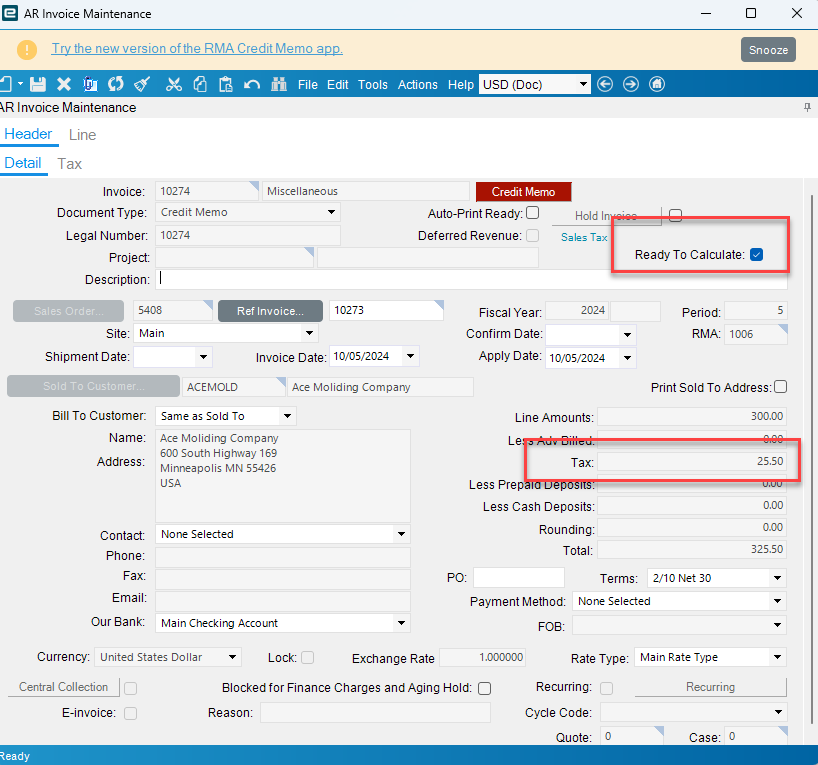

You will note that the Tax field is populated and the Ready to Calculate is checked.

You can also force a manual tax re-calculation if you go to the actions menu and click the calculate tax menu item

The main reason (if not the whole one) for the Ready to Calculate flag is to automatically calculate the taxes and for the Avalara integration. If you don’t want to be sending and paying for spurious Avalara/Tax Connect tax trans then typically you leave Ready to calculate off until the final step then save… Turning off Ready to process/calculate in company config does improve performance in SO entry, however… If people forget to process etc (although I thing there is a warning in SO so you don’t forget. (I’m from Aus so anyone more familiar with Avalara chime in…)

So that’s classic. Note that there are a few different ways to process RMAs, my example is only one.

Kinetic

Assuming we have already created the SO in a classic screen with ready to process enabled.

- Create New RMA

- Add the RMA line

- Receive it

- Add a new Credit

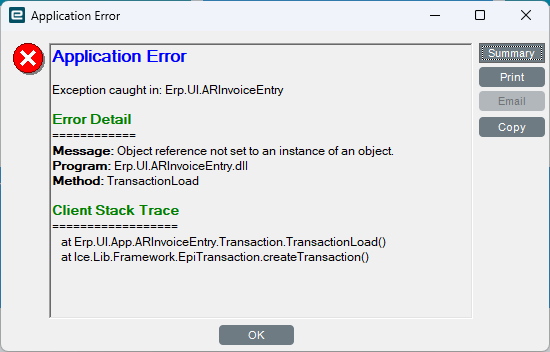

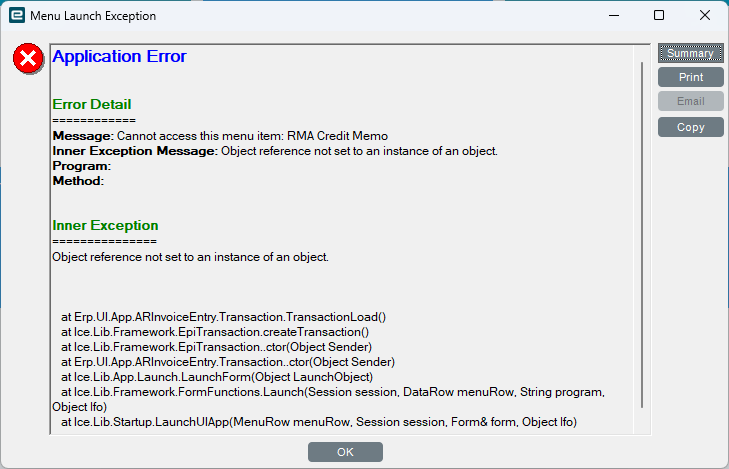

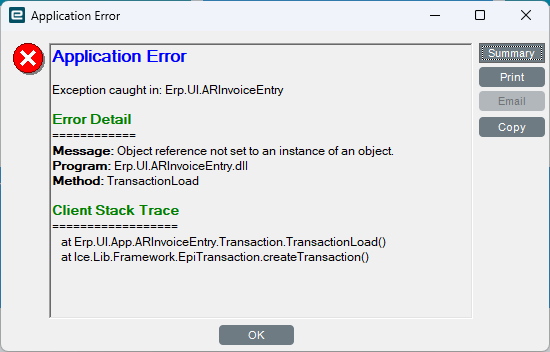

This is where things for me get a bit messed up. When I tried to add the credit I go and object reference error.

then

This was through the client. When I did this thought the browser it added the credit with no error (interestingly the credit was added before the error occurred so it must be something to do with the way the credit form is being called, when you use the rich client. It might just be my preference when I changed it back to User choice it loaded the classic version of the Credit/AR Invoice entry screen up) so identical to the one above with the Tax Field and the ready to calculate and the actions menu item.

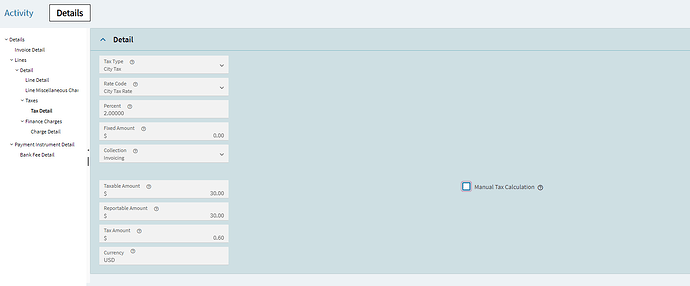

When I loaded Kinetic up in the browser I got a different experience. Adding a new credit it opened a new tab for the Invoice Group RMACRREQ (which is the default RMA credits group by the way, you don’t actually see that in classic).

The Ready to Calculate was already checked and the tax had a value in it…

Searching through the overload menus I did not see a Calculate Tax menu like in classic, However I did see on the Taxes detail tab a Manual Tax Calculation field all the way over on it’s lonesome…The field help indicates that this is for giving the user manual override on certain fields in this form for changing the taxes manually, not sure why you would do that…

What appears is that the Ready to calculate flag updates the tax on saving the form and if you leave it enabled and you change anything on the credit memo that would effect the tax then the act of saving the record would recalc the tax.

Disabling the flag, changing something saving it, then reenabling the flag and saving will also recalculate the tax, so my thought is that Epicor considered the Calculate Tax in the action menu as superfluous and left if off in Kinetic.

A couple of thoughts, as to why you might be seeing this issue

- You might be doing it differently to the way I have demonstrated. For example skipping the legal number and just entering in the order number in the RMA line (I did go back and test that and raising the credit the tax still showed)

- Your Tax liability is not configured on our customer records.

I tested this on 2023.2 base so that might account for that weird location of the Manual Tax Calculation Field.

Anyway I hope the information helps. I sure had a lot of fun messing around in this version vs 2022.1 and a highly customised RMA screen to get around some of the limitations that it has and the way people perform their RMA processes.