Hi,

We have a bunch of parts setup which were setup for the purchase of Sales Orders and Invoices. They are not quantity bearing and are for things such as mobilisation, service hours, calibration, configuration charge. Often there is a job created for these (Make Direct to the SO).When the job is complete (complete qty = 1) then it is shipped and invoiced. The problem I have is that the MFG-CUS is always zero. I assume this is because the part is setup as standard cost (which I think is the only option). Has anyone else overcome this so the MFG-CUS tran actually has a value for a non qty bearing part on the job?

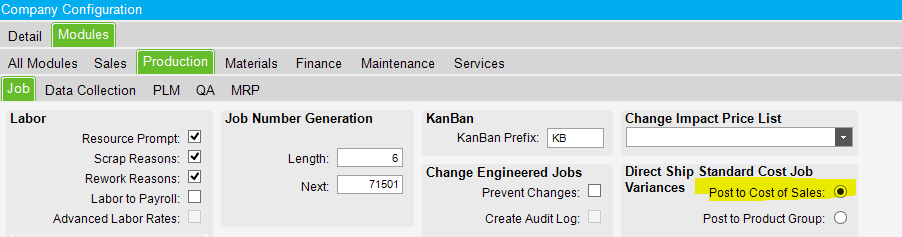

We do have a similar setup. When the job is closed, it will create MFG-VAR transaction, which will post to COS. Check Direct Ship Standard Cost Job Variances as Post to Cost of Sales in Company Configuration.

Wowwwwww… I always just modified the product groups. Never knew that.

I think you’re right on std. cost - if it’s zero, that’s what you get.

But I’ll say I ran into something yesterday that drove me nuts. We had a MFG-CUS that came through at zero but it was for a qty-bearing, last-costed item (and the job had plenty of cost on it). Invoiced it; still zero. Came back this morning, and now there’s the cost. No idea why it would not show immediately.

![]()

It just seems weird that there is never a cost on MFG-CUS an it is always considered a variance. Makes it hard to do easy links for revenue vs cost.

It’s not never.

- If the costing method is standard the transaction is for the standard amount - which could be zero

- If the costing method is last (like us, usually), there is no variance on the shipment BUT you may not see the amount the instant you make the shipment. I found that out this week when I made a BPM to block zero-dollar transactions.

This all assumes, by the way, that there is cost on the job already - that material has been issued or backflushed and/or labor has been charged (or subcontract charges).

If there is no cost on the job when you ship it, then cost you put on the job AFTER the shipment will go to variance.

Jason,

Can you have a Non Qty Bearing part set up as last cost? It seems it only allows standard. All our costs are on the job when we ship it.

Thanks.

ASH GROUP W.A. Pty Ltd

A.B.N. 92 164 615 285

efficient business systems, streamlined processes, effective reporting

Nope. I dislike that restriction also, especially for washers and expensed items. If I don’t want to even bother to inventory it, what makes Epicor think I want to maintain its standard cost?! In that case, though, last cost isn’t even updated by the system anyway, for the precise reason that it is not quantity bearing. So you lose either way.

As for finished goods that are non-quantity-bearing, consensus seems to be “why would you do that?!” I also fought this for a long time, but I have had to cave on that.

I guess it is some sort of norm that finished goods are qty-bearing, even if they are made to order. Maybe some kind of GAAP reason?

Epicor has two sets of cost related fields in InvcDtl table. Fields starting with JC will have cost in this scenario and you can get correct revenue and cost for each invoice line.