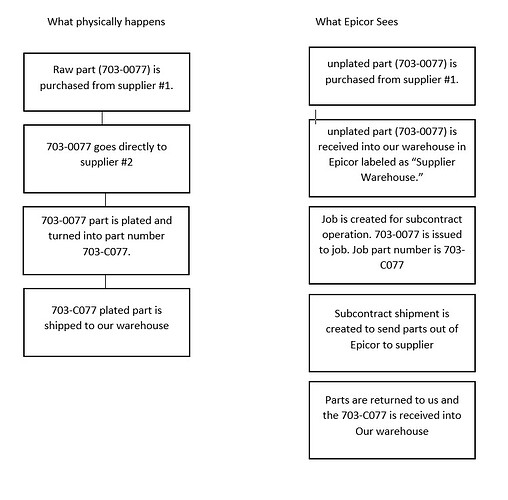

We have a part that we order from supplier #1 (Part# 703-0077) that goes straight to another supplier (#2) for a plating operation and turns into a plated part (703-C077). We pay supplier number 1. The parts will sit at supplier number 2 waiting to be plated for a while. Once plated they get shipped to us and we pay supplier #2.

As far as Epicor is concerned, we received the raw part (703-0077) into our warehouse so we can pay supplier number 1. A subcontract job is created for the final plated part (703-C077) and the 703-0077 part is issued to the job as a material. A job subcontract shipment packing slip is created for the job and the (703-C077) part shows up on the pack slip. A PO for this plated part is also created so we can received it back in once it’s shipped back. Once plated they are shipped to us and we receive them into Epicor. The job is completed and eventually closed.

2 issues arise from this:

Issue for Purchase Planning and Purchase Suggestions

We are always getting suggestions to order more of the raw part (703-0077) to fulfill the min on hand requirement because it thinks we have 0 on hand. Technically we have part issued to the subcontract plating job for (703-C077) so we actually do have some they have just been issued to a job so they could be sent out for a job subcontract operation.

Issue for Accounting

The issue for accounting is sometimes these parts sit at our supplier for an extended period of time. We have paid supplier number 1 so we assume the liability for these parts, but they technically aren’t on our books because they have been shipped out to supplier 2. At the end of each month accounting does a journal entry to record how many parts are sitting at our supplier. We have to track how many parts are at the supplier using an external spreadsheet which isn’t ideal and the accountant has to do manual entries.

Does anyone else have this scenario in their business? How do you have it setup to allow accounting to keep it on the books properly and do purchase planning?