We had an employee date an inventory transaction today with the year 1948. Is there any way to prevent this? Is there anything in company set up to stop things from being backdated?

Earliest Apply Date prevents this from happening. You can set the for all transactions or by module.

I don’t believe that EAD would stop a date “behind” the EAD just ahead of it. Jill would have to back the transaction out and recreate it with the correct date.

Charlie

Having Earliest Apply Date (EAD) setup prevents user entry of a date that would create a transaction prior to the date setup.

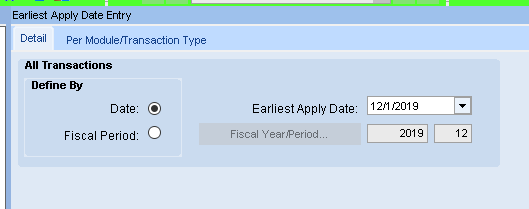

With EAD setup as:

(there are no type specific entries. So all contexts will use that 12/1/2019 date)

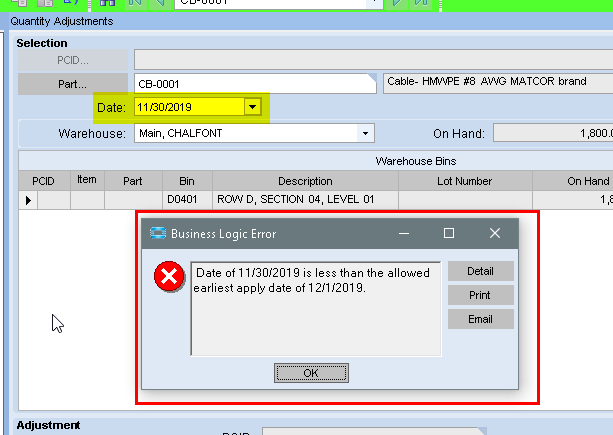

I can do a Qty Adju dated 12/5/2019. But trying to do it with a date of 11/30/19 gives me:

If you do have to correct a mis entered entry, do so before enabling the EAD.

Thank you! I thought of that but wasn’t sure.

Jill

It looks like it even catches transactions that occur without the user entering a date.

For example, We had a PO receipt on 12/13/19, marked as Received. If I set the EAD to 12/15/19, open that receipt and try to uncheck the Received box, I get:

That’s because the marking the receipt as Received, creates PUR-STK transactions with positive qty’s, and a tran date of 12/13/19.

When the receipt was “un-received” (by clearing the Received checkbox), it creates PUR-STK trans with negative qty’s, and a tran date of 12/13/19.

Earliest apply date stops transactions from being posted into prior periods.

We did set up a date for the Inventory Production Module and then again tried to close a job with a date of 1948 and it let the job close and the material to show up in 1948. Is job closing under a different module? Is job closing exempt from an EAD?

Job Closing doesn’t create any part transactions so EAD won’t stop it. A job can be reopened and closed with a new date at any time though, so this is easy to correct.

From a transaction standpoint, the biggest impact job closing is going to have is clearing WIP to COGS and variance accounts. These transactions don’t occur until a cost capture is performed. Cost capture should post any “old” transactions to the first day of the current fiscal period.