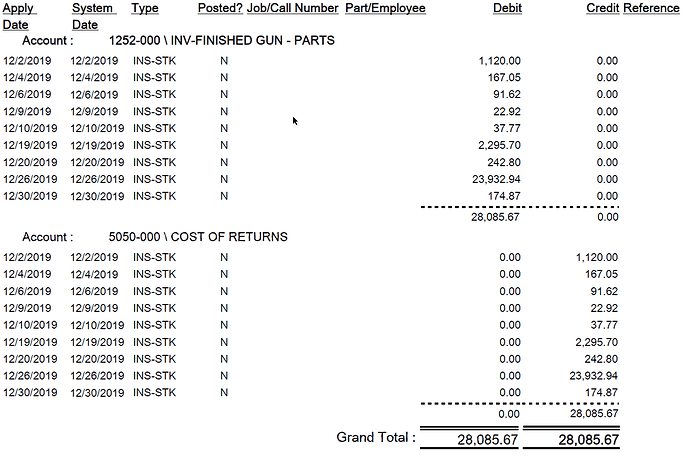

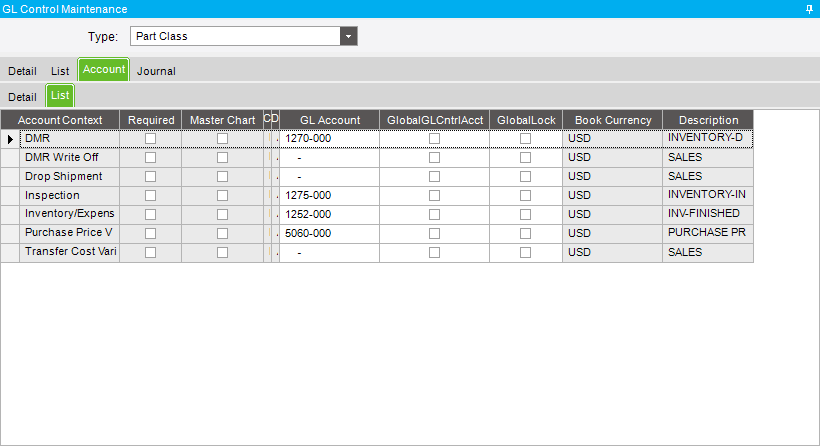

I looking for some help from the master I see on here. We are a few months into our e10 implementation and I was reviewing the Inventory WIP Recon report and noticed an oddity in our Cost of Returns GL account. When I investigated it, I discovered that for some reason the INS-STK (Inspection to Stock) transactions are Crediting thru the Cost of Returns GL account instead of our Inspection GL account. I reviewed the Inventory Transaction Hierarchy and it indicates what I would expect. STK-INS and then INS-STK based on Part Class control code. (we use part classes) I reviewed the Part Class Control code accounts and they look okay. Is there anywhere else where there’s a setting that might be controlling this? Am I missing something else?

Does it matter how the parts got into INS? In other words, does the flow of

- PUR-INS -> INS-STK

do the same as:

- ASM-INS -> INS-STK

- MTL-INS -> INS-STK

- STK-INS -> INS-STK

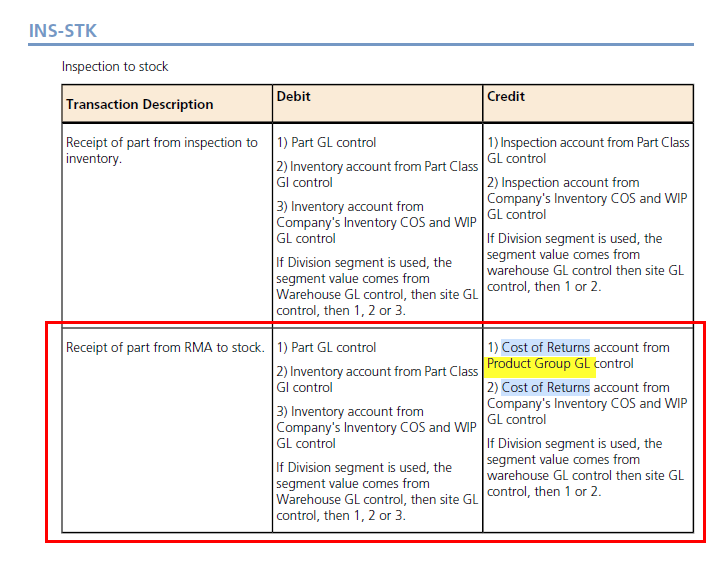

- RMA-INS -> INS-STK

Are these being processed as RMA’s? Seems like they would hit Cost of Returns

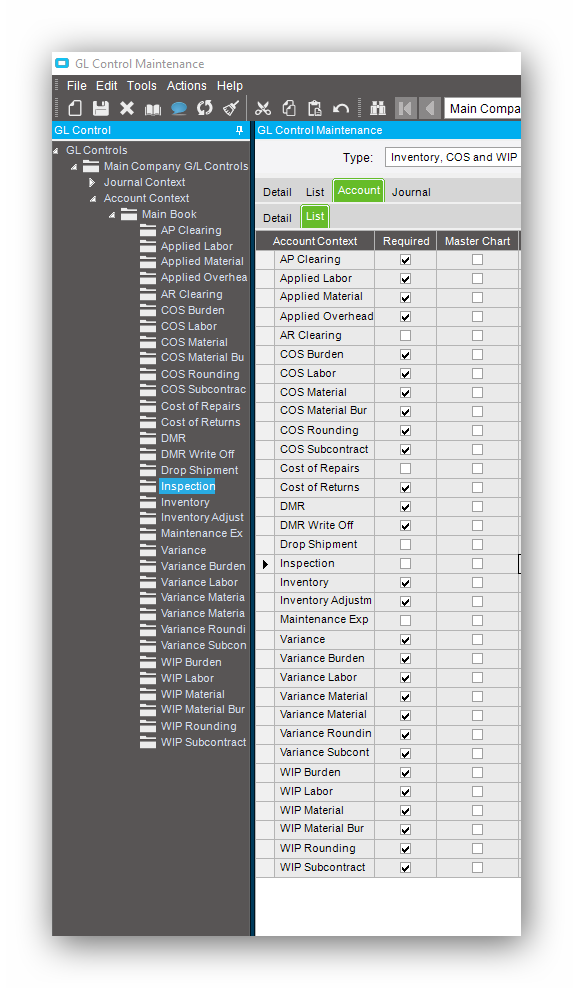

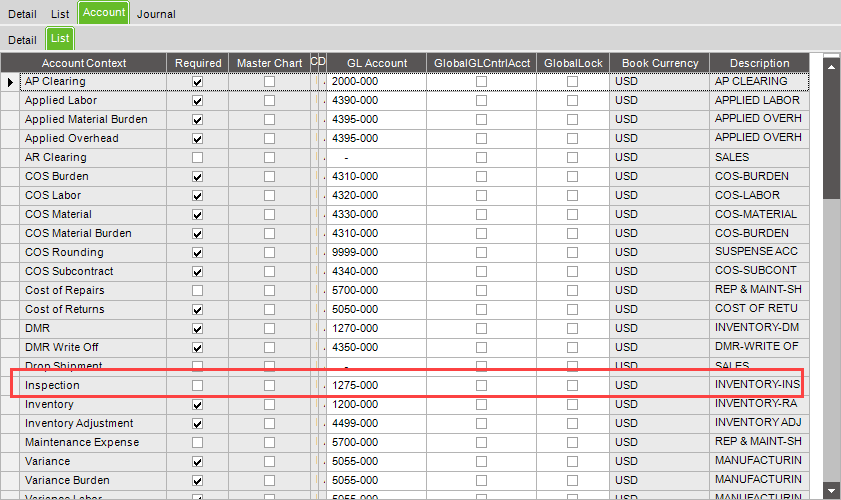

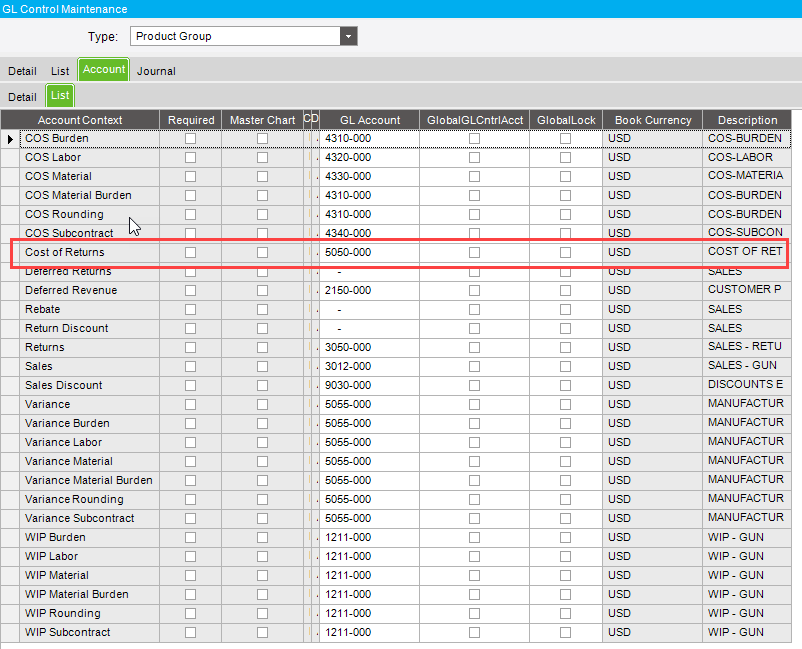

Check your Inventory, COS and WIP GL control code and see what, if any, account is listed for the Inspection context.

It would seem that this is basic process. When moving from inspection to stock, you would relief inspection warehouse and add to inventory warehouse. I’m understanding what’s sending it to the Cost of Returns account.

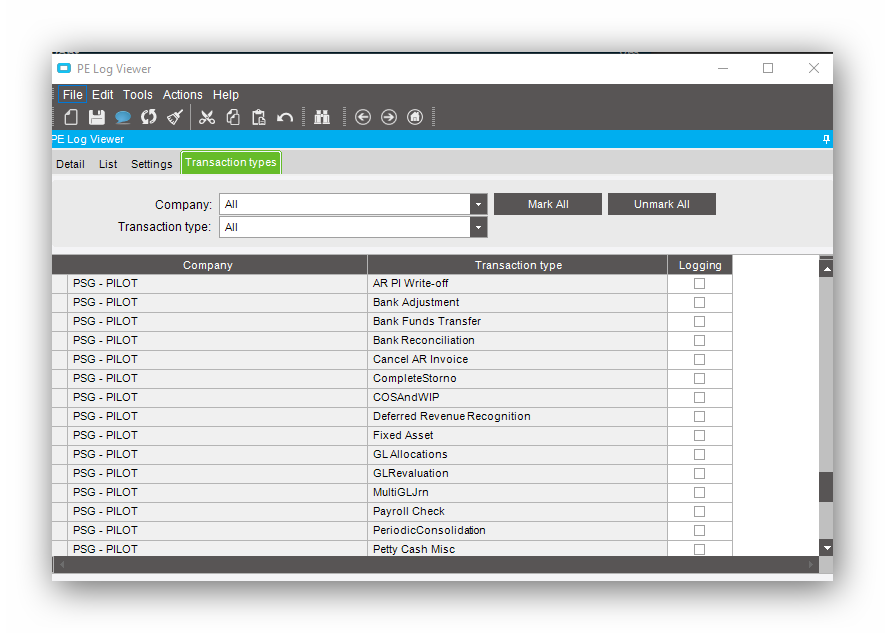

You can use the PE Log Viewer to turn on Posting Engine logging for COS and WIP, run the Inventory COS/WIP Recon report, and then view the posting engine log to see how it’s coming up with the Cost of Returns account.

Run the WIP Recon for a larger span, to see what tran type is putting that into INS, and which GL accounts are being hit.

I’m trying to use the PE Log Viewer mentioned above. I’ve never done that before.

I think @ckrusen was onto something about the way these parts made it into Inspection. I’m looking at our Inventory/WIP report and it looks like any parts that were received back from an RMA don’t even touch the Inspection Inventory accounts – If they’re returned to stock, Cost of Returns is credited and Inventory is debited; if they’re rejected to DMR, Cost of Returns is credited and DMR Inventory is debited.

I would have thought receiving the RMA would credit Cost of Returns and debit Inspection Inventory, but it seems that isn’t the case.

I have the PE Log but, I’m not sure what to do with it. LOL

Yeah, I can understand the flow from an RMA standpoint. I think these are from PO receipts and/or nonconformance.

I’ll try to verify what’s putting the transaction there.

Run the WIP Recon, with Trans Types filtered to just RMA->INS. Set the date range pretty wide so you don’t miss it.

Oddly, I have no RMA-INS transaction in December. May not be situation for December.

If an RMA receipt doesn’t create any GL entries, there won’t be any on the Inv/WIP Recon report. Check Part Transaction History Tracker for a couple sample parts to see if they have RMA-INS part transactions.