Every “default” GL account that is used is specified by a GL Control. What I mean by “default” is that a specific account will be used for specific conditions. Even the most core GL accounts (like your Raw Materials Inventory Acct) must be specified somewhere. These core accounts are usually company specific. So they are specified in the Company Maintenance (or is it Company setup? I can never keep those two straight). They are set by using GLC’s (GL Controls).

GLC’s can be very confusing at first. A GLC is attached to a specific business usage, consider these as GLC Types. Some example GLC Types are:

- Inventory COS and WIP

- Product Group

- Part Class

- Reason Code

(there are probably somewhere between 50 and 100)

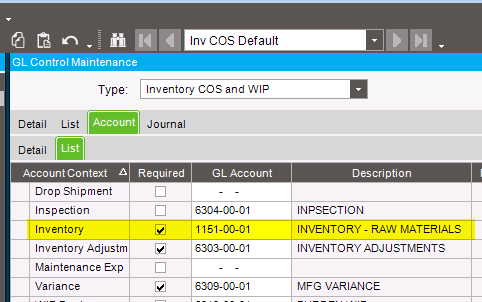

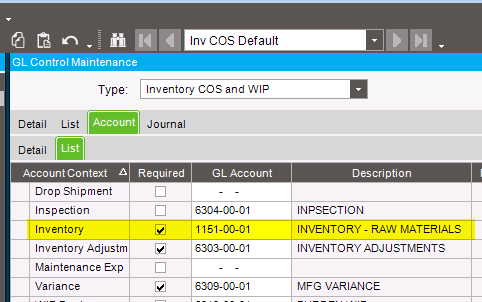

Within a Type GLC will be several contexts. For example, the “Inventory COS and WIP” there are contexts like what is shown below:

The highlighted line shows the GL account to use for the Inventory context of the “Inventory COS and WIP” type. What is not shown is that this is just one of several settings for the “Inventory COS and WIP” type. This one happens to be named “Inv COS Default” (a name I chose).

Now I have a defined GLC. It has the following properties:

- Type: “Inventory COS and WIP”

- Name: “Inv COS Default”

- Contexts:

- Drop Shipment: No account set

- Inspection: 6304-00-01

- Inventory: 1151-00-01

- and more (including WIP, COS, etc…)…

Now anywhere a GLC of type “Inventory COS and WIP” can be applied, I can select my “Inv COS Defaults”. But you don’t want to just use it all over the place. You want to understand the hierarchy and set his only where it needs to override another GLC - or at the most basic level, as there are no default GL accounts.

The only place I need to use this GLC is in Company Maintenance. That sets the “default” GL account to use for Inventory transactions.

If there are circumstances where i don’t want an inventory transaction to go the Inventory GL account, I can create other GLC’s that can be used to override the base ones. An example would be best.

Say you have a SHop supply that you want to track the QOH, but it is to be expensed upon receipt. Making it a Qty Bearing in part master will enforce track qty transactions. However, it will also default to your main Inventory GL Control. To make the transaction hit the desired expense account instead of the Inventory GL, do the following:

- Make a new GLC Code

- Type:

PartClass

- Code:

SHOP

- Description:

SHOP EXP (5160) (I like to put the GL acct in the description)

- Acct Context INV/EXP:

5160-00-01

- Make a new Part class for Shop Expense named “SHOP SUPL”, and add the GLC

SHOP

- In part master for your shop supply item you added, set the Part class to “SHOP SUPL”

Now when you receive that part on a PO, it hit 5160-00-01, instead of 1151-00-01.

It’s a lot to take in. You best bet is to experiment in a test environment.