We have a part we assemble for STK and also use in finished systems. We had a quantity adjustment that zeroed out the unit cost. Then when we pulled some from STK to build a system, we got a cost of zero for them (8 of the 40 anyway) until we replenished STK at a new, much higher cost. What caused material cost to go negative? Why did it remain zero? This uses average costing.

What is the Cost Method for this Part on Part > Site?

Average Costing Method

Since you’re on avg cost, zeroing out the qty also effectively zeroed the average cost. I’m not sure what you mean by “Then we pulled some from STK”. Pulled from where? I see a job variance too. Maybe look at that particular job?

I didn’t think hitting a zero on hand updated any cost. I thought average costs were only recalculated on Receipts (PO or MFG)?

If zeroing qty causes zero cost, how/when does cost get updated?

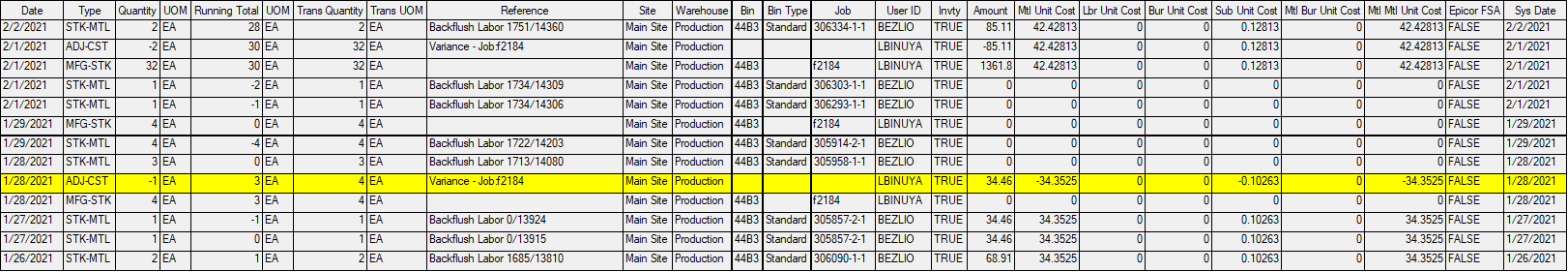

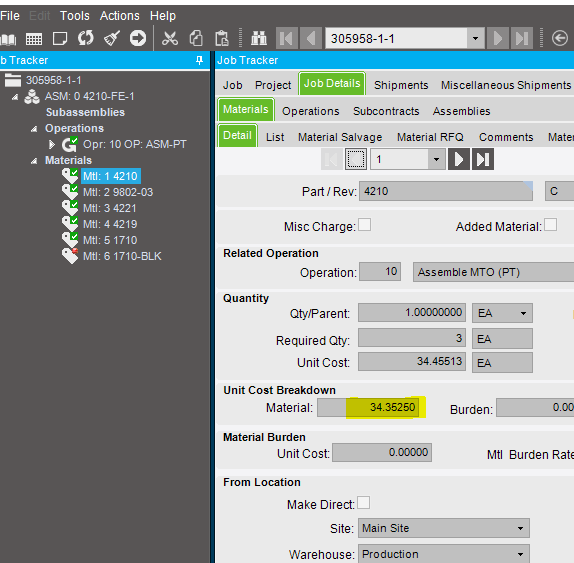

There were STK-MTL transactions at zero cost on 1/28 and 1/29. Job materials had costs.

The cost will still be there, but the weighting should be zero, meaning the next receipt will override the existing value.

So the MFG-STK transaction on 2/1 that recorded the receipt from the job to stock was the trigger for updating the avg cost in the part trans table? Why did MFG-STK transaction on 1/28 change cost to zero? The ADJ-CST on 1/28 made the cost go negative - why?

10.2.500.30

This is because the MFG-STK transaction of 4 on 1/28 is at zero cost. Since there was no qty in hand before that the new average cost becomes zero.

Vinay Kamboj

Zeroing out the qty does not have any impact on cost.

Vinay Kamboj

Because the avg cost before that was not zero. The mfg-stk transaction came in at zero cost. So the system did an adjustment to change the avg cost in the system to zero which can only by done by making a negative adjustment.

Vinay Kamboj

This is a timing issue. Raw material was issued to the job after the material was put into stock from the job. For the costs to flow to stock correctly correct sequence of transactions is very important.

Vinay Kamboj

![]()

How do we make sure raw material is issued first, before putting into stock?

You would need a BPM to stop the Job Receipt to inventory transaction unless all material is issued. This could have unforeseen negative consequences though. Such as slowing down transactions down stream.

Are the parts in question not getting issued because of backflush or are these not getting picked?

This is more a case of user training and following the process. Alternatively, you could backflush the raw material if possible.

Another way would be write BPM to check raw material issue and labour booked or not.

But in these cases it is always best to go to the basics and make sure the users are trained to following the sequence.

Vinay Kamboj

I made a BPM here (Data Directive on PartTran) to block zero-dollar transactions.

I had to refine it because I found that even with costs, MFG-STK would go through at zero at first for like a few seconds or minutes, and then something in the system updates it. That threw me for a loop.

Tangent, unrelated to a discussion of average costs

I also realized PUR-STK goes through at actual cost. We do standard costing, and that was odd to me since MFG-STK goes through at standard. Either way there is a variance, but I wonder why the different methodologies. Point is, blocking zero-dollar transactions didn’t work for PUR-STK for standard costs.

One other “gotcha” with average costing and Jobs for Stock.

If you don’t report qty produced on the job, before receiving a qty less than the jobs production quantity, to inventory, the cost will be zero regardless of whether or not mtl was issued to the job, or any QOH.

The costs for the subset of the job remain in WIP. Only when a receipt to inventory happens for the final production quantity, will the WIP be used to calculate a cost of the manufactured part. And only for the qty of this last receipt.

Say:

-

Part ABC-123 has a current cost of $20.00 each, and there is a QOH of 5. The value of Inventory of this part is $100.00

-

A job is created to make 10 for stock. The materials for one of ABC-123 cost $21.00 (one of the components when up by $1.00)

-

Enough material to make all 10 is issued to the job. Inventory goes down by $210.00 (10 * $21.00), WIP goes up by $210.00

-

(5) of the part are made (but not reported as produced qty), and are received to stock.

These 5 will go in at a value of $0.00. The cost of ABC-123 will be recalculated as:

(5 x $20 + 5 x $0) /(5 + 5) = $10.00

This makes the value of Inventory $100.00 (10 x $10 each). No change to Inv GL, and nothing came out of WIP GL either. -

The last (5) are received to stock (again no production qty’s reported). These have a unit cost of: (WIP value / this qty)

($210 / 5) = $42.00 each

The (5) at $42 create a new avgerage cost of:

(10 x $10 + 5 x $42)/(10 + 5) = $20.67

The new value of inventory is (15 x $20.67) = $310

The $210 increase is exactly equal to the drop in inventory value of the parts used to make those last 10.