Right now our buyers are having an issue where they can’t modify the cost of a part received if that part is in inspection. We’re currently using DMRs to modify these parts which isn’t working ideally so I was wondering what others were doing when they come across these situations. Any feedback would be greatly appreciated!

Have you tried:

- “un-receiving” it (no idea if it being in Inspection complicates this)

- Updating the PO

- “re-receiving” it.

Not really practical if you have to do it a lot. but will work for Items received to stock(PUR-STK), to WIP(PUR-MTL), or expensed(PUR-UKN).

But it must be done before the AP Invoice is entered. As you can’t “un-receive” a receipt that has an invoiced against it.

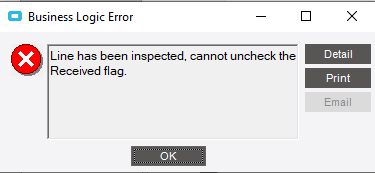

Unfortunately, you can’t unreceive something if it’s in inspection.

You are correct @Amay, once it’s passed receiving to Inspection you can’t update the PO. At this point it would require a journal entry to fix the costing, and all sorts of nightmarish things to “fix” the inventory value. When this happened at a company I worked for, it wasn’t a big enough deal for my CFO to want to do the work (and we were on average costing, so it did directly affect inventory value). If you’re on standard cost, it’s just journal entries to “fix” the variance account… if you’re on Lot Average (and only a single lot is involved) or FIFO it can be just a Cost Adjustment, but if you’re on Average Cost it can be time-consuming.

Thanks Ernie, we use standard costing and we’re using DMRs to clear the receipt, then creating a new receipt with the correct pricing so the changes can be systematically tracked. What I discovered today is that we weren’t clearing the original receipt out of the AP Clearing account (receipts not invoiced) and therefore we were overstating our expenses and AP Clearing balance. If we invoice the original receipt then use a misc invoice line to clear the invoice balance to the PPV account, we’ll then get accurate PPV. Thank you to both of you for taking the time to provide feedback.