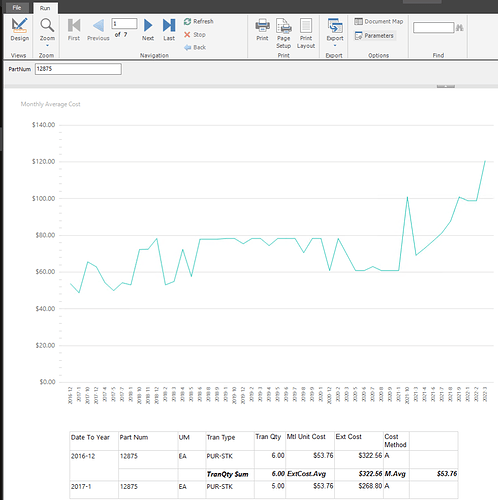

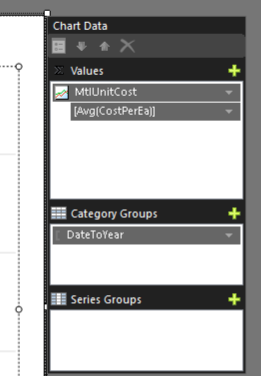

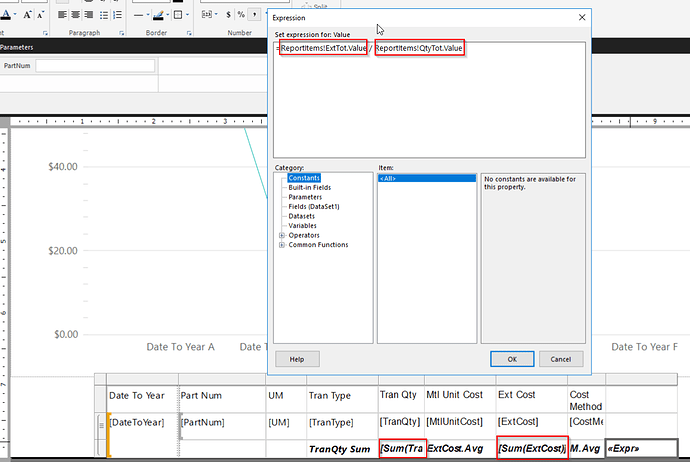

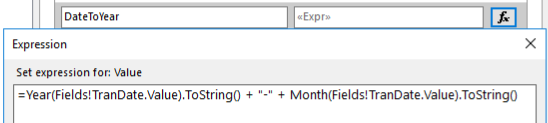

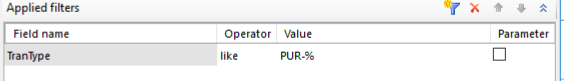

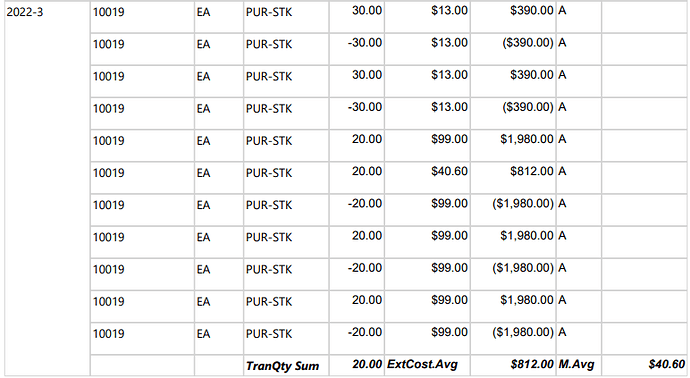

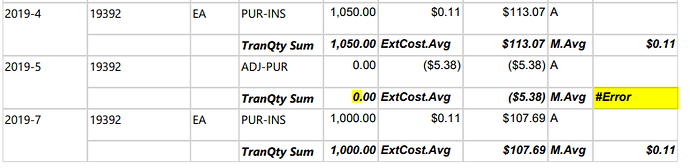

Purchasing department was very surprised today when they noticed some Average costs we’re being set as Last Cost. I found the below article on the Epicare site, basically states that if a part goes to zero qty, the average cost resets. Their department would like something so they can see trends in averages, so i’ll probably start working on a dashboard with pretty bar graph. I think i can use PO transactions for that.

Curious if anyone has similar situation with their department using Cost Average.

Frequently Asked Questions

1. What do we need to check first if we believe that the Average Cost for a part does not seem to be correct?

The first thing to consider is if the part was received directly to the job. If the part was received directly to a job and not into inventory, then the cost will go directly to the job and not to the part. Review the Part Transaction History Tracker for PUR-MTL transactions.

2. What are other areas to check if the parts were not received to a job?

Look for parts that were received directly to inspection and verify if the costs are still in inspection.

3. How are the costs calculated for the Average Costing method?

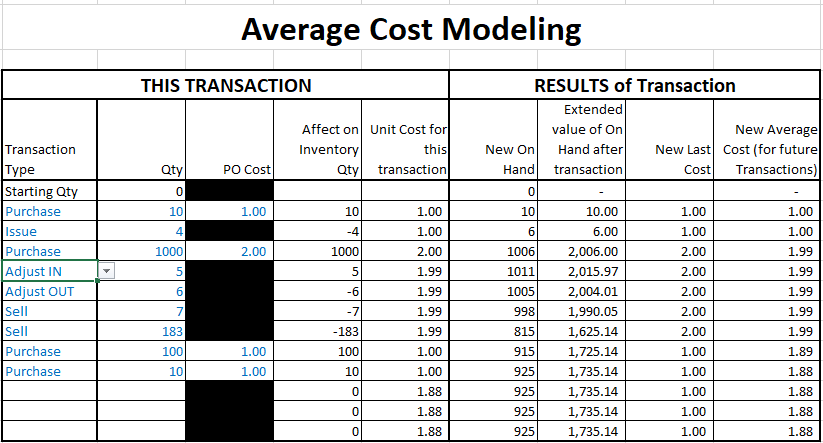

This method calculates the weighted average of all receipt costs for all parts in this cost group. Costs recalculate every time a receipt transaction is processed. The application calculates Average cost for all parts regardless of their default costing method.

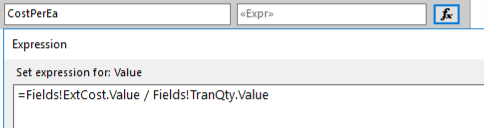

(previous onhand qty * previous avg unit cost) + (receipt qty * receipt unit cost)/new onhand qty)

4. How are the costs calculated for Average Costed parts that are Purchase Direct or Make Direct?

These are never received into stock so there is no receipt to average into the calculation. The costs go directly to the job.

5. Why does the system show both Average Cost and Standard Cost for parts that are set to Average costing?

Regardless of which costing method you use, the application always maintains both the average Unit Material

cost and average Unit Material Burden cost (if calculated)of each part. You can display these average unit costs

within Cost Adjustment. You can then see these values as you modify the unit costs of the part.

6. What does the weighted part of the calculation mean to me when verifying costs?

The above formula will only work and be accurate when the onhand quantity is greater than 0. When the onhand qty drops to 0 or below, the Average cost will be overwritten with the full new value from the next PO to stock (PUR-STK) or next incoming Job qty to Stock rather than being recomputed using the Weighted Average Cost formula. This is because the formula will only work and be accurate when the on-hand quantity is greater than 0. Then once the onhand qty remains above zero in successive incoming receipts to stock, from Purchase Orders or Jobs, then it will again start recomputing the average cost using the Weighted Average cost formula.