We usually send out our POs as tax exempt.

When we go to invoice it, sometimes suppliers charge us tax (which is fine in those situations), but we are trying to find a way to add the tax to the invoice and still match it to the PO.

For instance, if there was 1 line on the PO at $100.00, we might receive an invoice for $100.00 plus $5.50 sales tax.

If we add that tax onto the header tax tab, it creates a variance for the invoice and will not allow us to post it since it doesn’t balance.

How are other companies handling scenarios like this?

You could add it as Misc header charge but i believe you would need to setup the header charge GL control acct under : Financial Management > Accounts Payable > Setup > “Miscellaneous Charge/Credit”

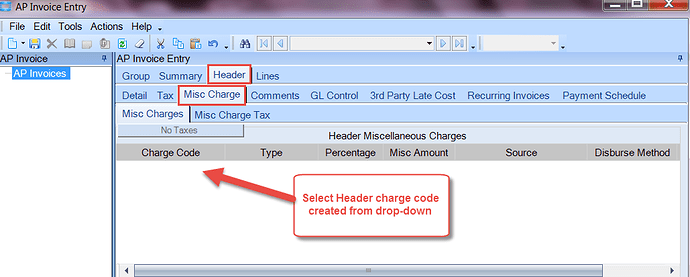

Create by naming the Misc charge and assign a GL control to it. Next time entering AP invoice, enter the normal invoice amount and instead of New Receipt Line, there is New Header Charge. Select the one you created from the drop-down and enter the tax amount.

How would I make sure that the GL that’s associated with the invoice is the same as the header charge?

Also, what’s the proper way to use the Header Tax tab?

After looking at some of our old AP invoice entries, it seems like our tax is entered via Misc Line instead of Misc header charge. So, our AP personal is manually entering the tax amount and GL account same as invoice GL.

The Misc header charges, we use that for expediting fees, freight, etc which has fixed GL accounts already linked to the GL control assigned. In your case, since you want all the tax GL to be same as the invoice, my earlier suggestion may not work.

If you know when the tax applies (by either purchase point or part/purchase point) I would set up the appropriate tax fields for purchasing so the tax will be on the PO. That way the supplier can acknowledge that the PO is correct and it will make the processing flow through to AP.

I’m told they don’t know the tax at the time of the PO and only get it once they receive an invoice from a supplier.

If this were me, I would push back and say that they need to understand their business process better before I could help them. I would bet that if a supplier incorrectly taxed them, they would be all over that (at least I hope, for your company’s bottom line sake).

That being said, in your current circumstance, I would create a misc line charge and set it to 0% and then change it as needed. I still think there will be a PPV because the invoice still won’t match the PO. If that is the case, then the PO will need to be changed to avoid the PPV.

Oh, and the GL Account will go behind the misc charge that was created.