Dear Experts, We observed that Fixed Asset disposed during the year are getting depreciated for current period as well, which actually shouldn’t be depreciated after disposal. Please suggest how to stop depreciation of disposed assets for current period.

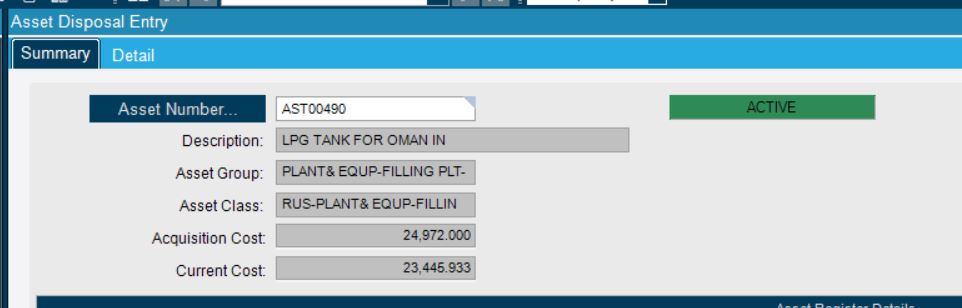

This may not help, but I notice that the asset still has a cost in those highlighted periods. If you dispose of an asset, shouldn’t its cost be $0. If it is off the books then it shouldn’t have a value, right?

@utaylor - I think that is what his issue is.

@Hari_Dutt - The help says that you have to select the Ready to Post box.

Also, since its a Sale type disposal, maybe it doesn’t complete until after it is invoiced.

edit

Also, why was the disposal cost $1,526.067 ? Was that value determined by the program or something you entered?

@ckrusen, I agreed with your statement the help says that you have to select the Ready to Post box

Also, why was the disposal cost $1,526.067 ? Was that value determined by the program or something you entered?

Yes, Disposal Cost entered by the Account User.

How to check the ‘Ready to Post’ checkbox because Asset Disposal is posted?

How to reverse the posted disposal and depreciation?

From the screenshots, the user did a partial disposal. The asset is not fully disposed hence the remaining cost(23,445.933) is still being depreciated.

I can only guess that most likely he punched the figure for proceeds in the asset cost field instead of proceeds.

i don’t think we can reverse it once the transaction is posted, anyone else want to confirm.?

i got an issue where the account dept want to change/reverse the posted depreciation transaction from 100% “instant write off” depreciation to 25% “Diminishing” depreciation.

Any idea how to fix this issue ,beside start another new register?